All Categories

Featured

Table of Contents

If you take a distribution against your account before the age of 59, you'll likewise have to pay a 10% charge. The internal revenue service has enforced the MEC regulation as a means to avoid individuals from skirting tax commitments. Unlimited banking just functions if the cash money worth of your life insurance policy policy continues to be tax-deferred, so ensure you do not transform your policy right into an MEC.

Once a money value insurance policy account classifies as an MEC, there's no other way to reverse it back to tax-deferred status. Boundless banking is a sensible idea that supplies a range of benefits. Below are several of the pros of this unique, individual financing banking system. A non-correlated asset is any property not linked to the securities market.

You can reap the advantages of limitless banking with a variable global life insurance policy plan or an indexed universal life insurance policy plan. Yet because these types of policies tie to the stock exchange, these are not non-correlated possessions. For your plan's cash value to be a non-correlated property, you will certainly require either entire life insurance policy or universal life insurance policy.

Prior to choosing a policy, find out if your life insurance coverage firm is a shared firm or not, as just shared business pay dividends. You will not have to dip into your cost savings account or search for lending institutions with low-interest rates.

What are the common mistakes people make with Policy Loan Strategy?

By taking a loan from you instead of a traditional lender, the customer can save thousands of bucks in rate of interest over the life of the loan. (Just be certain to bill them the very same interest rate that you need to pay back to on your own. Or else, you'll take a monetary hit).

It's just one more method to defer paying tax obligations on a part of your earnings and create an additional security internet on your own and your household. There are some disadvantages to this financial method. Due to the MEC regulation, you can not overfund your insurance plan way too much or too rapidly. It can take years, if not decades, to build a high cash value in your life insurance coverage plan.

A life insurance coverage policy ties to your health and wellness and life expectancy. Depending on your clinical history and pre-existing conditions, you might not certify for a permanent life insurance coverage policy at all. With boundless financial, you can become your very own lender, borrow from yourself, and add money value to a permanent life insurance policy that expands tax-free.

When you initially read about the Infinite Financial Principle (IBC), your first response could be: This seems also good to be real. Probably you're cynical and think Infinite Financial is a scam or system. We intend to establish the document directly! The trouble with the Infinite Banking Principle is not the idea however those persons providing an unfavorable review of Infinite Banking as an idea.

As IBC Authorized Practitioners via the Nelson Nash Institute, we thought we would certainly answer some of the leading questions individuals search for online when learning and understanding everything to do with the Infinite Financial Idea. So, what is Infinite Banking? Infinite Financial was produced by Nelson Nash in 2000 and completely discussed with the magazine of his book Becoming Your Own Banker: Open the Infinite Banking Idea.

Cash Value Leveraging

You believe you are coming out economically in advance due to the fact that you pay no passion, but you are not. With conserving and paying cash money, you may not pay rate of interest, yet you are using your cash once; when you invest it, it's gone forever, and you give up on the opportunity to earn life time compound passion on that cash.

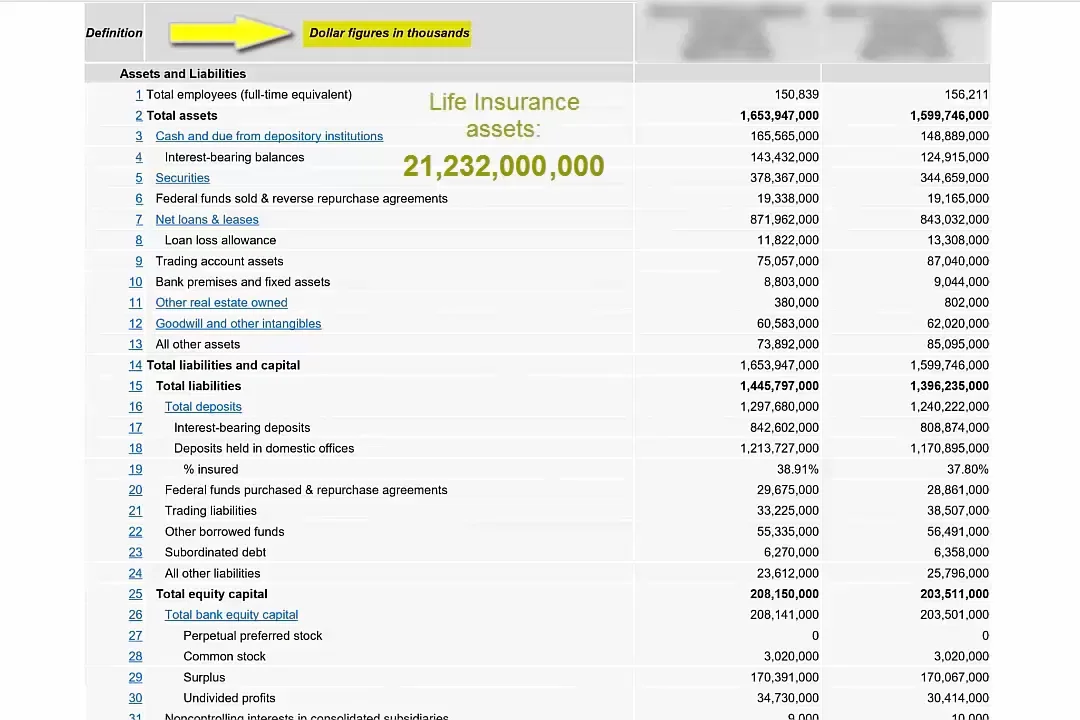

Billionaires such as Walt Disney, the Rockefeller household and Jim Pattison have actually leveraged the properties of whole life insurance coverage that dates back 174 years. Also financial institutions utilize entire life insurance coverage for the very same functions.

Can I access my money easily with Financial Independence Through Infinite Banking?

It allows you to produce wealth by satisfying the banking feature in your own life and the capacity to self-finance major lifestyle purchases and costs without interrupting the compound rate of interest. One of the most convenient methods to think of an IBC-type getting involved whole life insurance coverage policy is it is similar to paying a home loan on a home.

With time, this would certainly develop a "continuous compounding" result. You understand! When you obtain from your participating whole life insurance plan, the cash money value remains to grow undisturbed as if you never ever borrowed from it in the first area. This is since you are using the money value and survivor benefit as collateral for a finance from the life insurance policy company or as security from a third-party lender (referred to as collateral borrowing).

That's why it's imperative to deal with a Licensed Life Insurance policy Broker licensed in Infinite Banking that frameworks your participating entire life insurance policy appropriately so you can avoid adverse tax obligation ramifications. Infinite Financial as a financial technique is except everybody. Here are a few of the pros and disadvantages of Infinite Banking you should seriously consider in making a decision whether to progress.

Our preferred insurance service provider, Equitable Life of Canada, a common life insurance policy firm, focuses on taking part whole life insurance policy policies specific to Infinite Financial. In a mutual life insurance firm, policyholders are taken into consideration company co-owners and obtain a share of the divisible surplus produced every year with returns. We have a range of carriers to pick from, such as Canada Life, Manulife and Sun Lifedepending on the needs of our clients.

Who can help me set up Cash Value Leveraging?

Please also download our 5 Leading Inquiries to Ask A Boundless Banking Agent Prior To You Work with Them. For additional information about Infinite Banking check out: Please note: The product supplied in this newsletter is for educational and/or academic objectives just. The information, point of views and/or views revealed in this newsletter are those of the authors and not necessarily those of the supplier.

Table of Contents

Latest Posts

Be Your Own Bank: Practical Tips

Ibc Be Your Own Bank

Bank On Yourself Scam

More

Latest Posts

Be Your Own Bank: Practical Tips

Ibc Be Your Own Bank

Bank On Yourself Scam